Save time on your next private company valuation

Discover why PitchBook is now the only tool you need for valuations

Request a free trial

Discover why PitchBook is now the only tool you need for valuations

Request a free trial

Valuing a private company requires insight into the flow of capital across the entire venture capital, private equity and M&A landscape—not to mention the public markets. The process can take up a lot of valuable analyst time, especially if your firm uses legacy valuation tools and data that live on different systems.

By combining best-in-class private transaction data—including the world’s largest source of deal multiples and valuations—with public fundamentals and consensus estimates, PitchBook enables you to build more accurate comps with greater transparency and speed.

Whether you’re comparing companies or similar transactions, having the right data can mean the difference between closing a deal at the right price or missing out altogether.

Take the early-stage venture space, for example: While it’s no surprise that valuations are on the rise, the difference between the median and bottom 25th percentile has become increasingly narrow.

The margin for error when analyzing business comps gets even smaller when it comes to private equity pricing. Even though GPs have plenty of dry powder, the cost of financing has ticked up. Pair that with competition from corporate acquirers and the result continues to be lofty EV/EBITDA multiples.

Understand the complex factors that influence VC valuations across the US and Europe with analysis from PitchBook’s Institutional Research Group.

Download the latest US VC and European VC Valuation Reports.

Along with accuracy, speed is essential when building financial models. A thoroughly vetted transaction or company comparable analysis won’t do you much good if your target signs with someone else while you’re doing it.

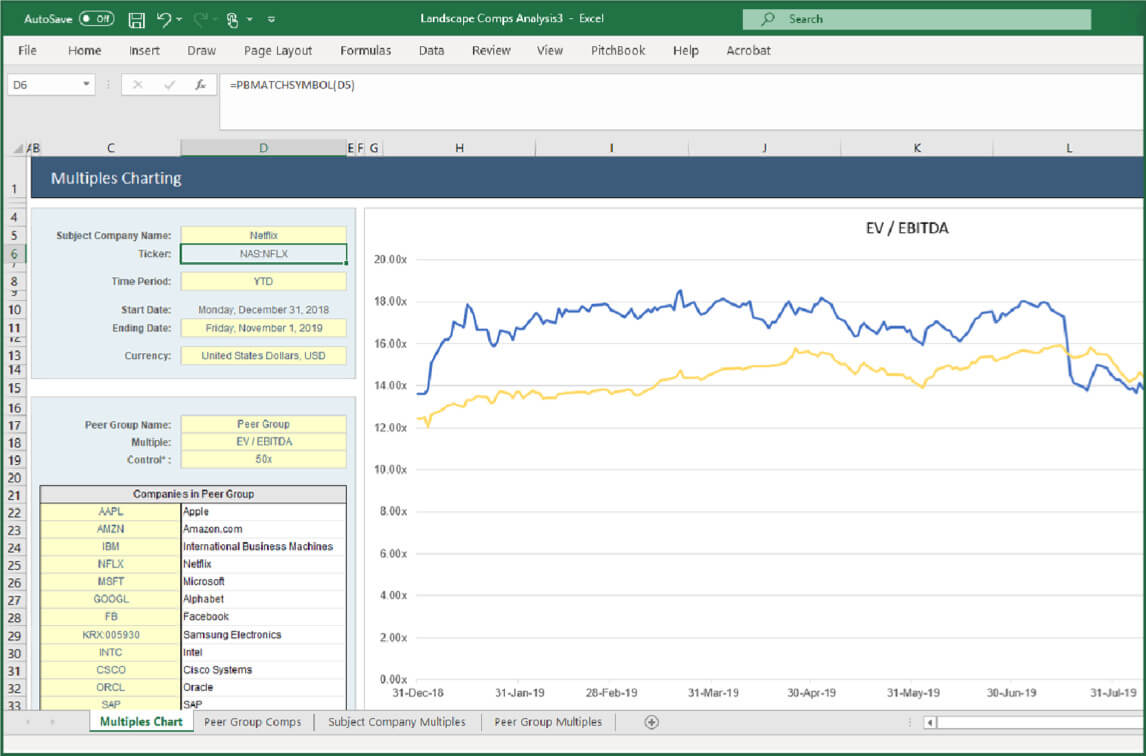

PitchBook lets you build financial models in a matter of minutes. By allowing you to quickly identify different types of funding rounds, companies and financings, PitchBook enables you to seamlessly navigate between datasets to find relevant transactions fast.

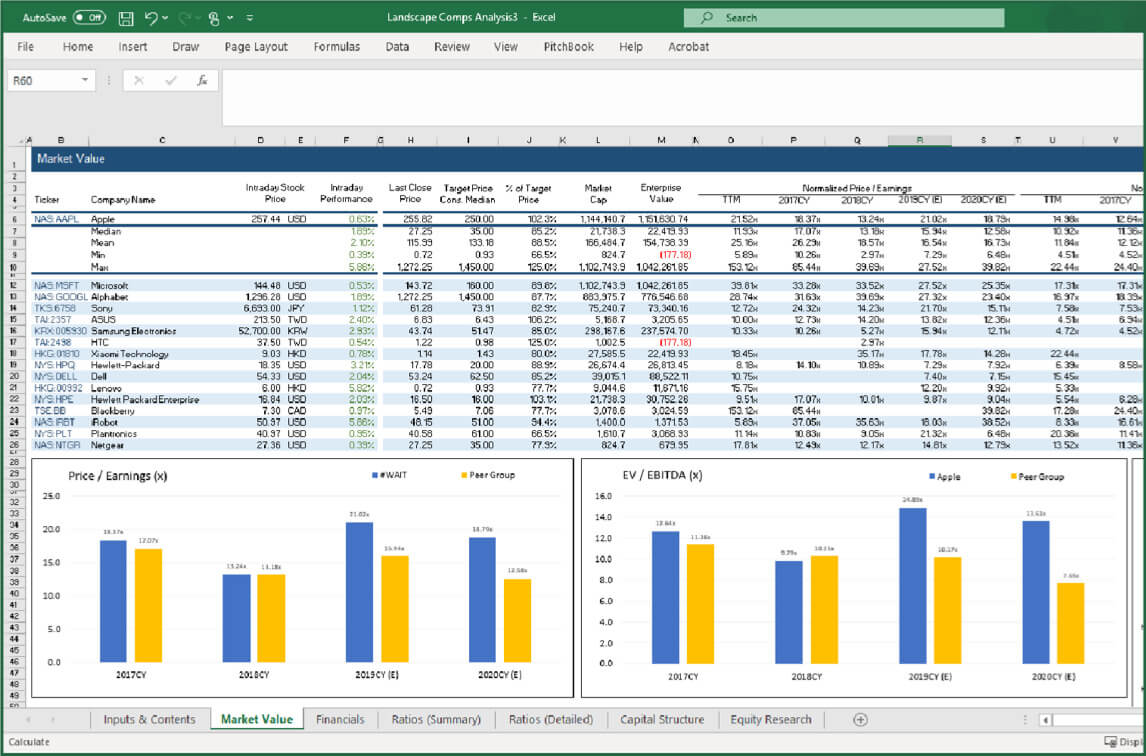

You can also easily run a screen based on thousands of criteria—like industry, vertical, keyword, deal size, deal type and more—to get to exactly what you need in minutes and delete anything irrelevant with a single click. You can quickly analyze your comps using powerful pivot tables too; or pull them into Excel just as fast.

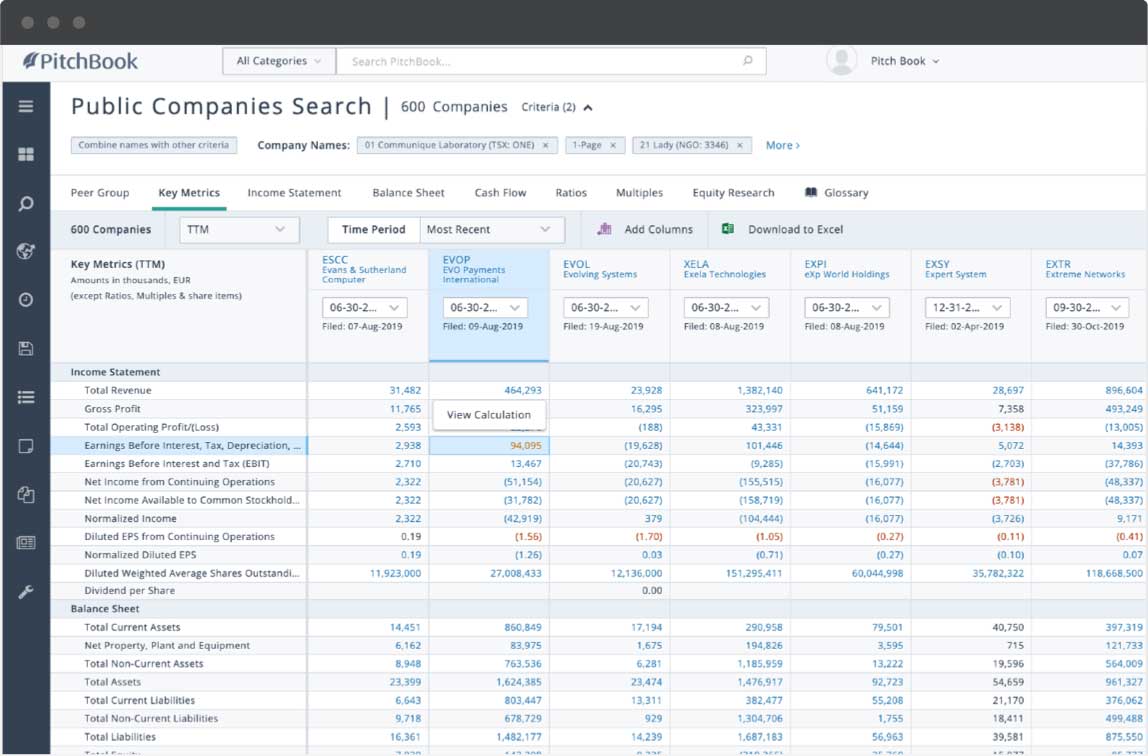

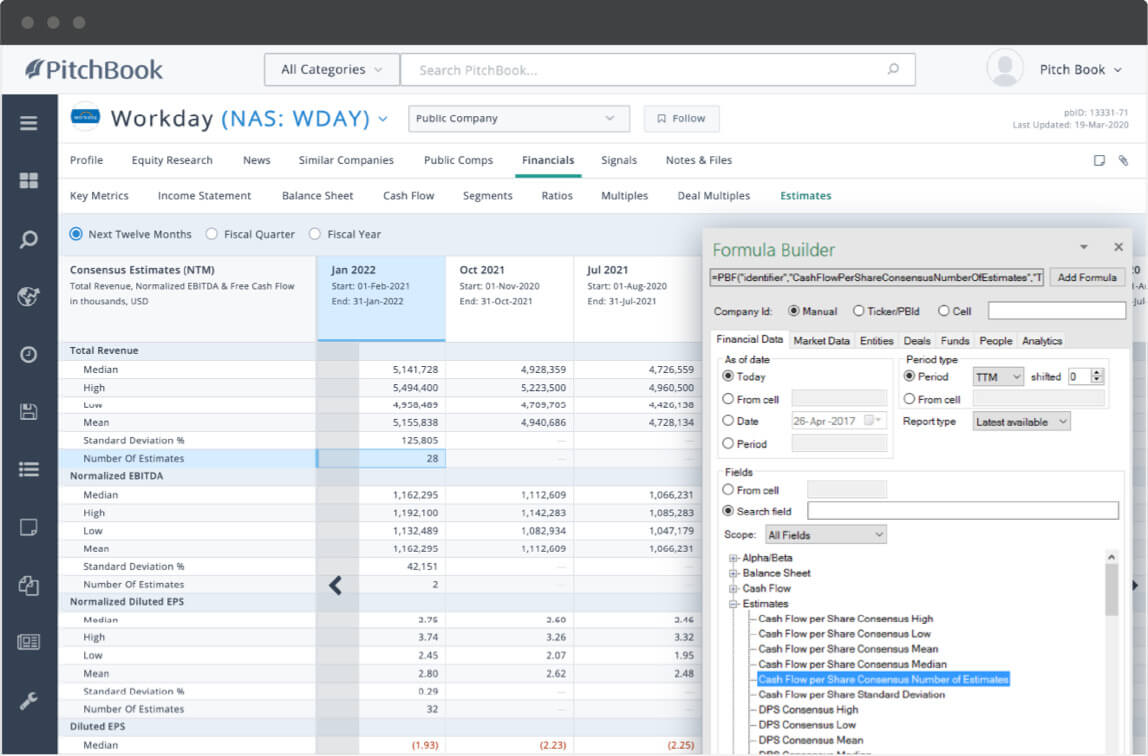

Quickly filter private comp searches by detailed metrics, including consensus estimates and forward earnings. Segment data further by trailing 12 months or calendar year.

Then effortlessly pull your comps list into either a prebuilt Excel model or your own custom one. You can easily save searches, add companies to a list and share lists with colleagues as well.

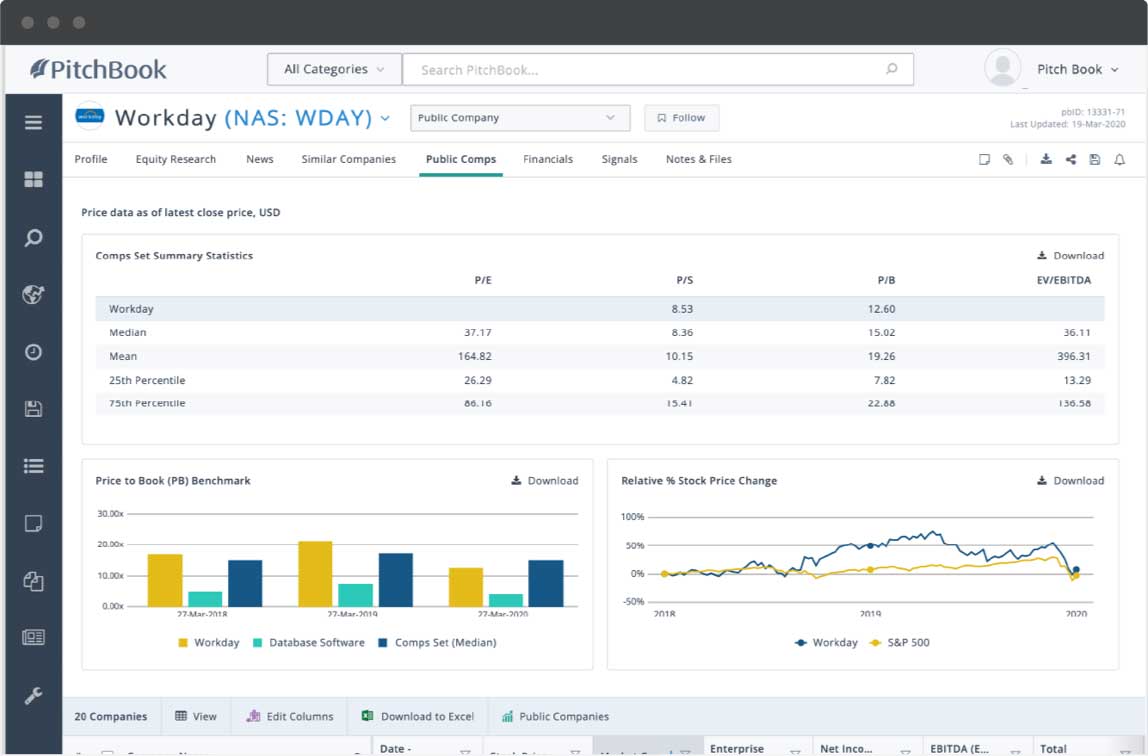

Reference key business valuation data at a glance and instantly see how individual companies compare to their peer sets using PitchBook’s Comps Set Summary Statistics window.

PitchBook also automatically serves up suggested peer sets with important valuation insights—so you can discover all the relevant public and private companies you need even faster.

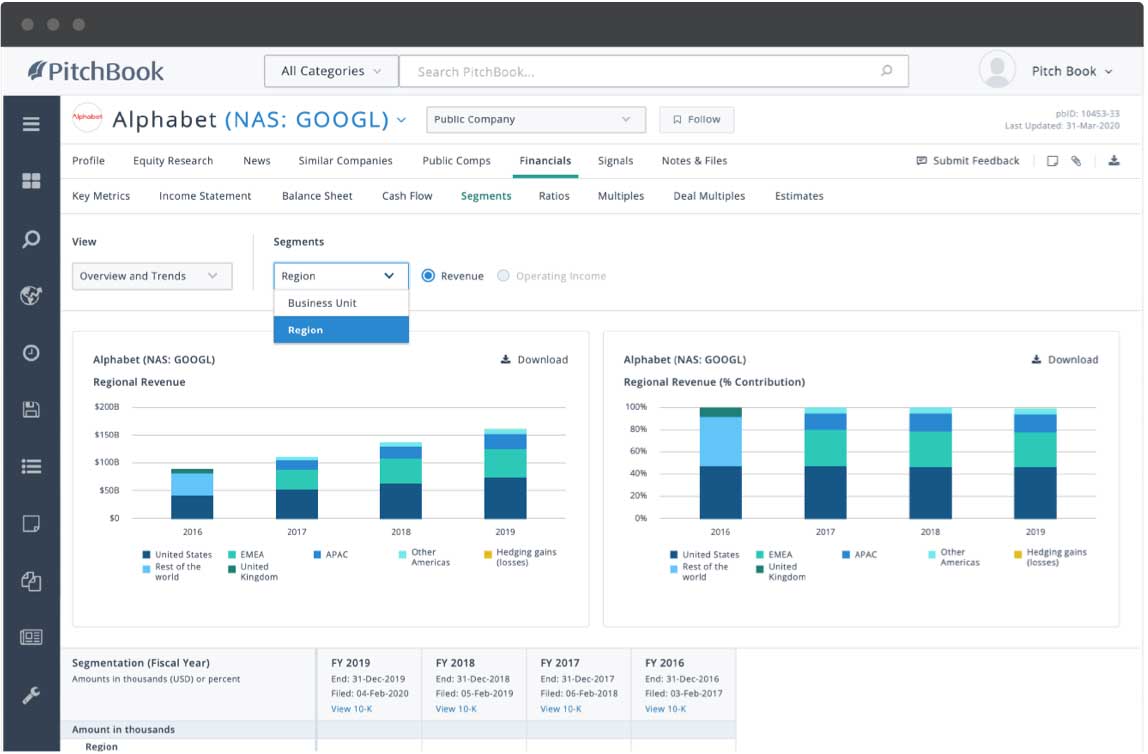

Analyze comps by specific business unit and regions- so you can know at a glance when you’re comparing apples to apples and when you’re not.

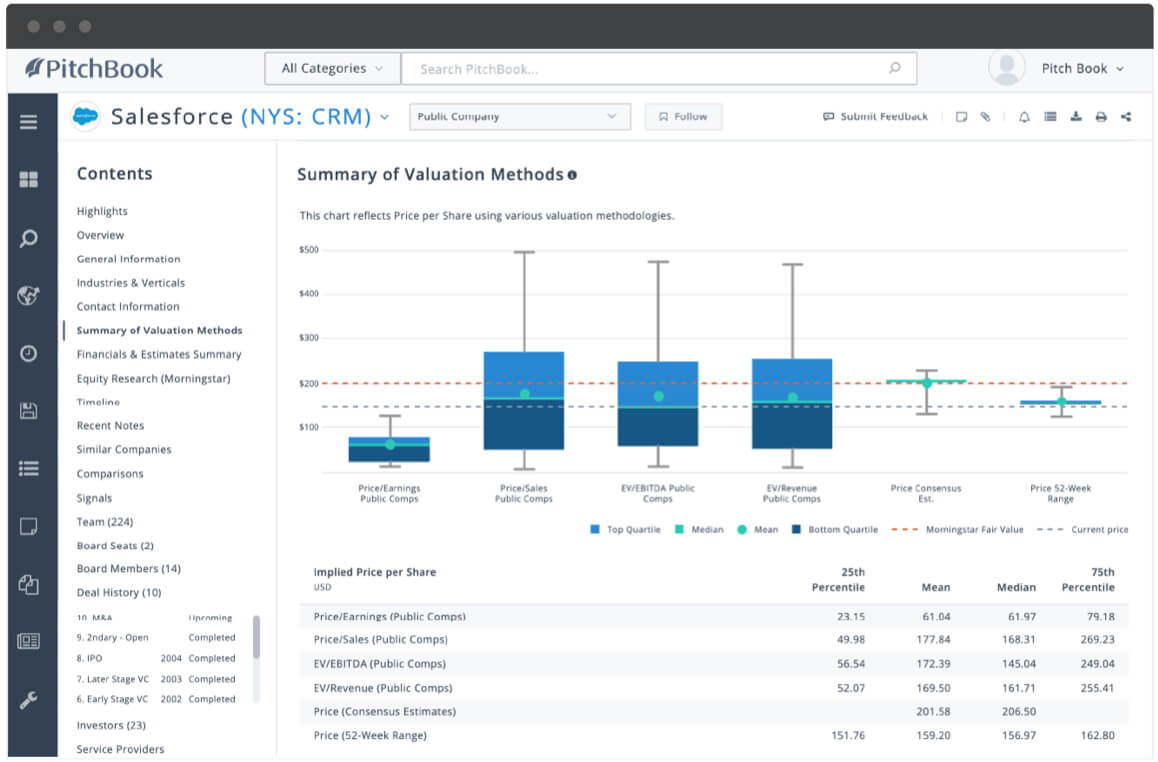

Instantly see how each valuation is calculated, including easy-to-understand charts and tables covering valuation multiples, such as:

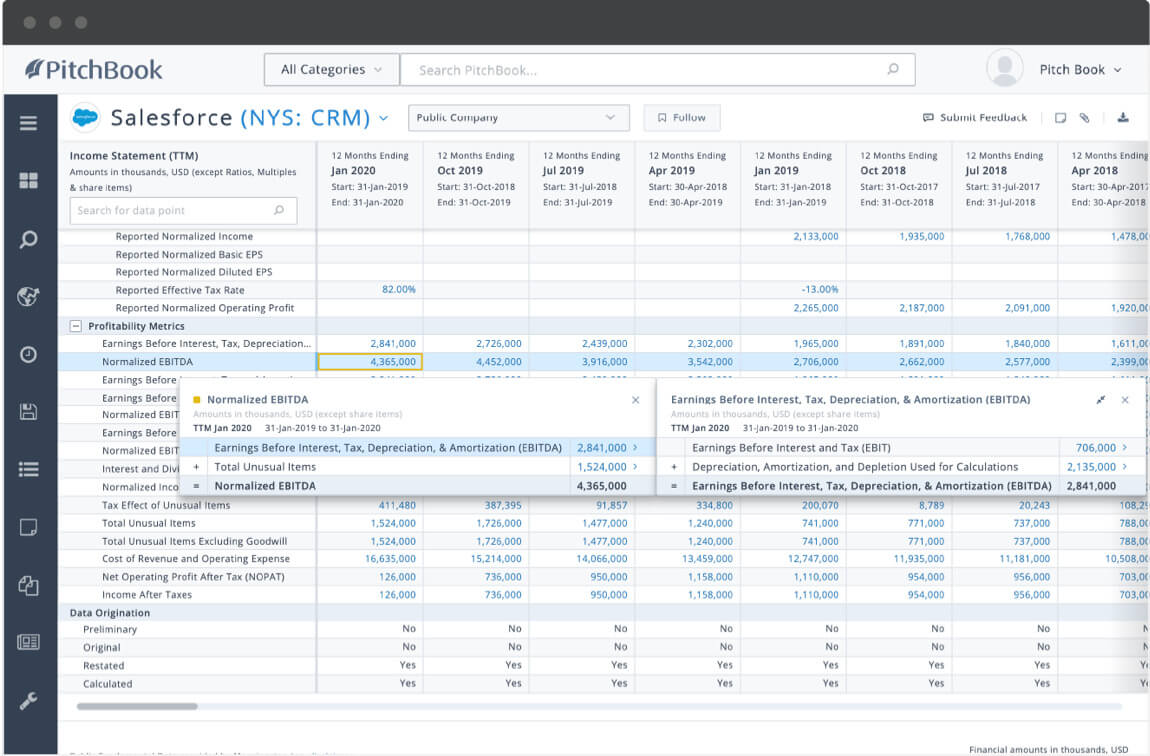

Drill down into any financial metric in a single click to see how it’s calculated and access a direct link to the source document where the information was pulled.

See forward-looking information based on Wall Street consensus as you build your comps multiples.

Easily understand if your target company or market space is at the top or bottom of a valuation cycle by creating a basket of securities to compare your target company and peer group stock index with major indexes.

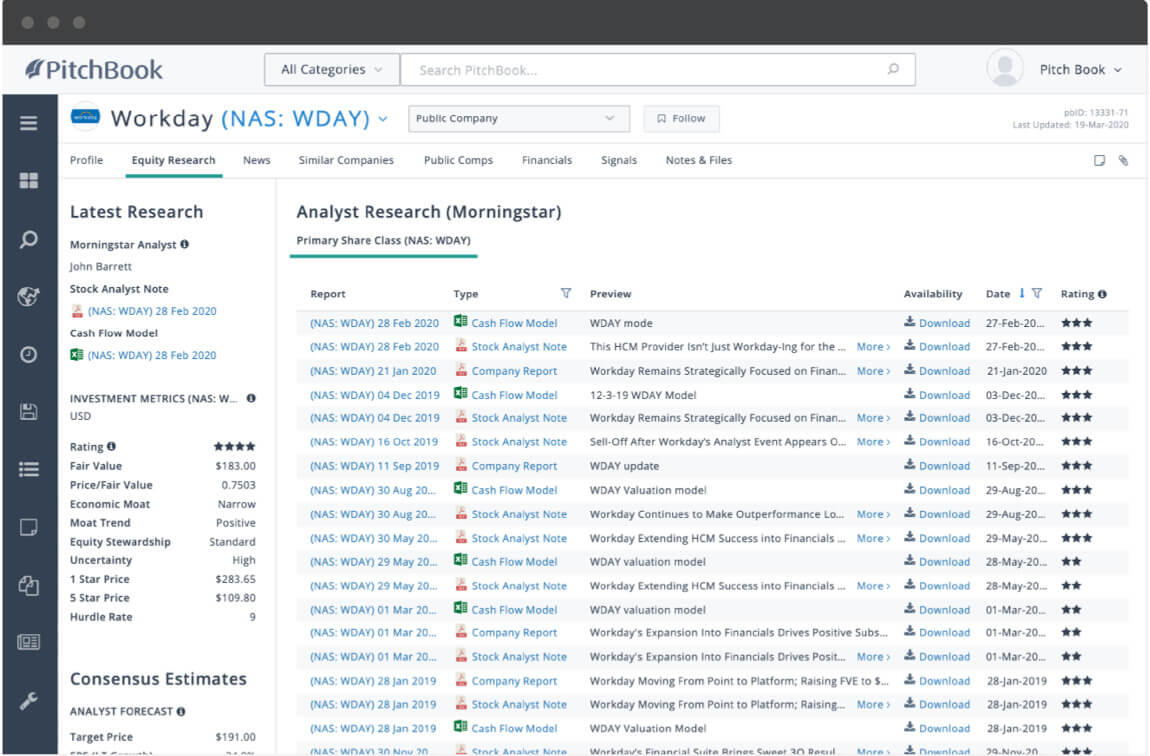

Access transparent valuation models on more than 1,800 public companies with a single click using PitchBook’s equity research powered by Morningstar.

Easily customize your private company valuation models to your firm’s unique approach using PitchBook’s Excel Plugin and get your findings presentation ready faster.