Find out what’s really driving returns with better benchmarks

Discover why PitchBook is the ultimate tool for timely, transparent benchmarking

Request a free trial

Discover why PitchBook is the ultimate tool for timely, transparent benchmarking

Request a free trial

Traditional private market benchmarks aren’t transparent—they fail to identify the underlying funds used, the investments those funds have made and even how those individual funds have performed. At the end of the day, this means important details that should be leveraged to evaluate performance are lost.

Miscalculating the performance of private market funds can have disastrous consequences. Inaccurate fund benchmarks can mean limited partners miss investment opportunities or make ill-fated allocation decisions. Importantly, it can also make fundraising significantly more difficult for general partners.

To illustrate fund performance with a higher degree of accuracy, PitchBook provides access to comprehensive, unrivaled fund data. With PitchBook, it’s easier than ever to see what’s really driving returns and customize peer groups to build precise benchmarks.

Leveraging a differentiated data collection process, the quarterly PitchBook Benchmarks report provides a snapshot of the most recent data available on how funds are performing across geographies and strategies.

Download reportPitchBook Benchmarks are derived from the largest universe of private market data, including information on portfolio construction, industry focus, size, type, vintage year, LPs and more across tens of thousands of individual funds.

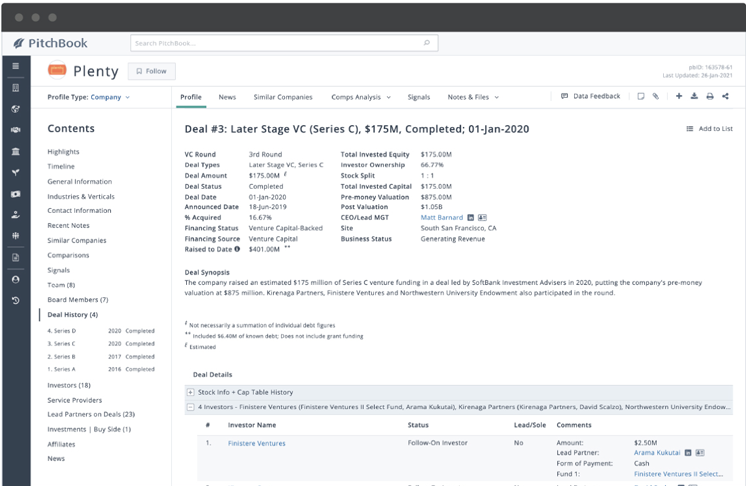

Determine which deals are driving fund performance with comprehensive information on millions of VC and PE deals, including their type, amount, status, deal multiples, pre- and post-money valuations, series terms and more.

PitchBook’s research and quality assurance teams have spent nearly 3 million hours researching, validating and solving discrepancies within our private market datasets.

PitchBook’s unmatched level of data accuracy and attention means you can make key decisions daily with confidence.

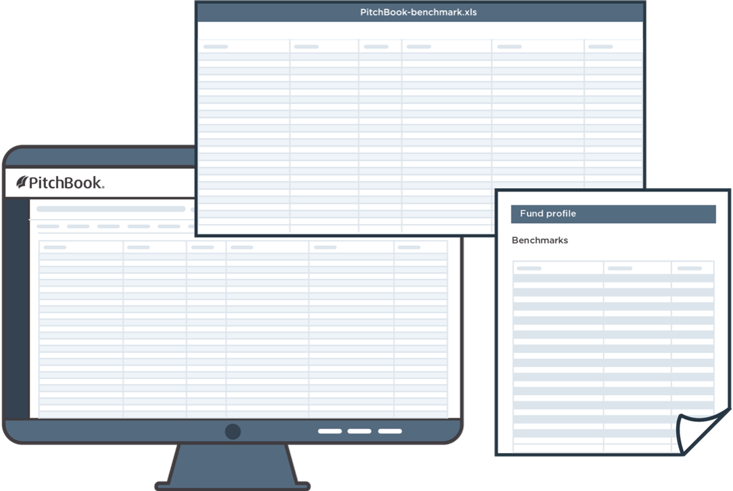

PitchBook’s benchmarks are delivered in PDF and Excel formats so that it’s convenient to reconstruct or create personalized reports that better suit your needs.

Our clients can also automatically pull and refresh the information they want directly from the PitchBook Platform—so it’s easy to keep benchmarks up to date.

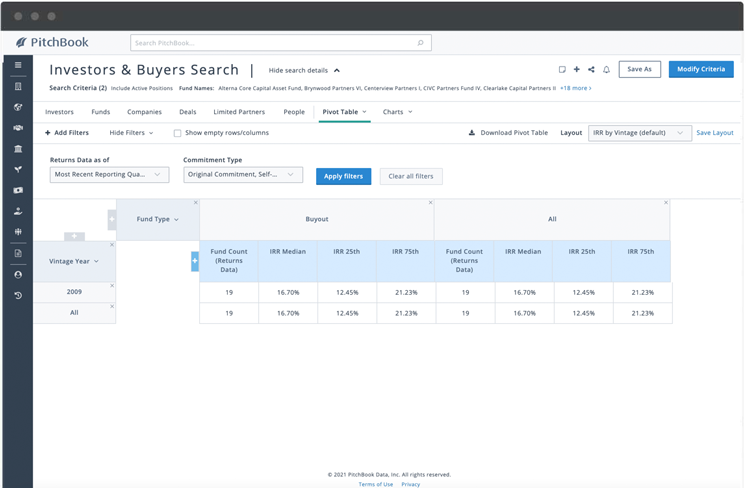

Effortlessly see how either your fund or a target fund stacks up against those in any custom peer group by using PitchBook’s pivot table feature to zero in on hurdle rates for top performing quartiles.

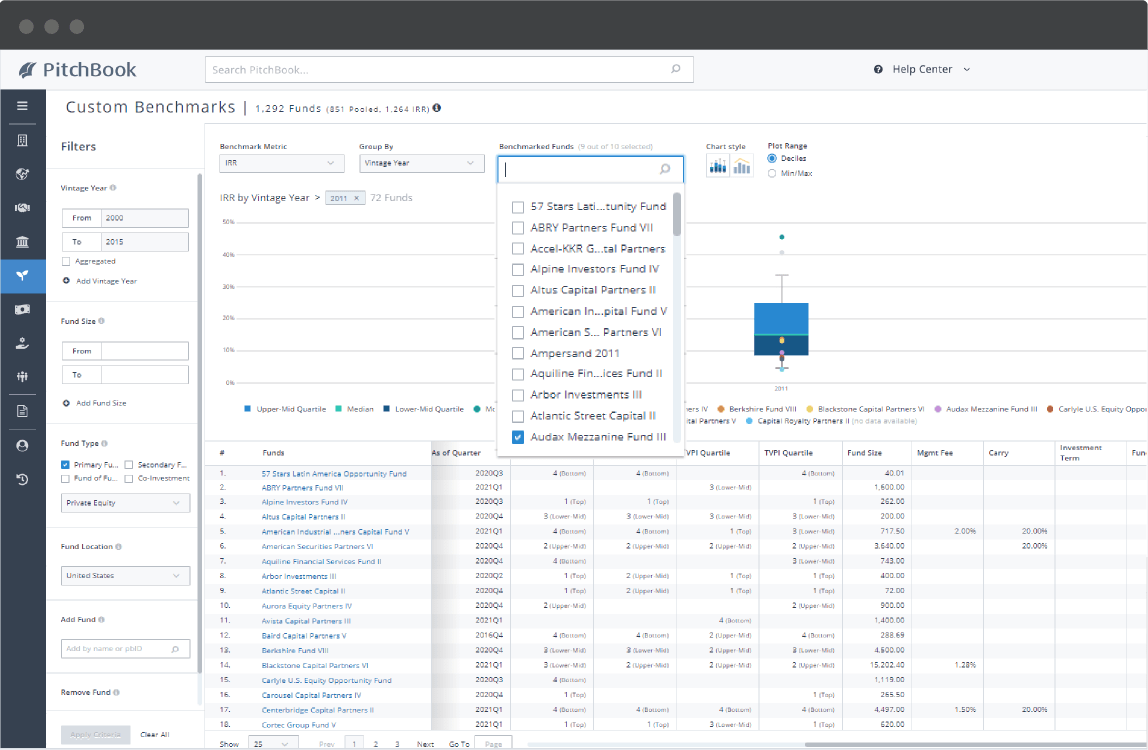

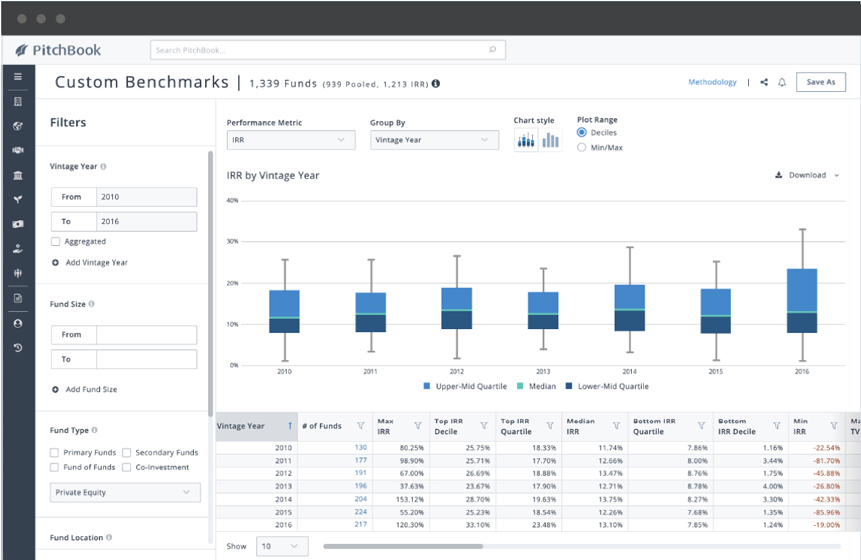

PitchBook gives you the ability to create your own benchmarks with custom peer groups based on the criteria that are most important to you—including similar funds’ portfolio construction, industry focus, IRR and quarterly cash flow multiples.

Plus, add or remove individual funds from your benchmark to further customize it.

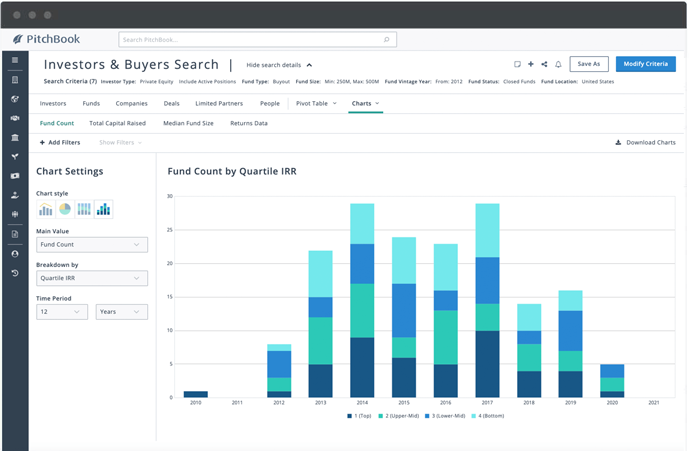

Create detailed charts, graphs and pivot tables with just a few clicks to easily compare metrics like IRR, TVPI, DPI and RVPI.

Then download your data visualizations as a PNG file, export your datasets to Excel or share your custom benchmarks with your team using PitchBook’s Collaborative Lists feature.

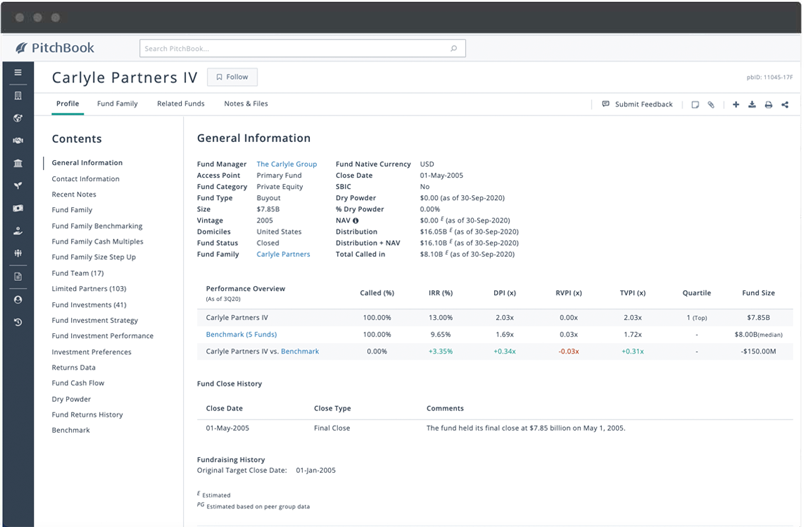

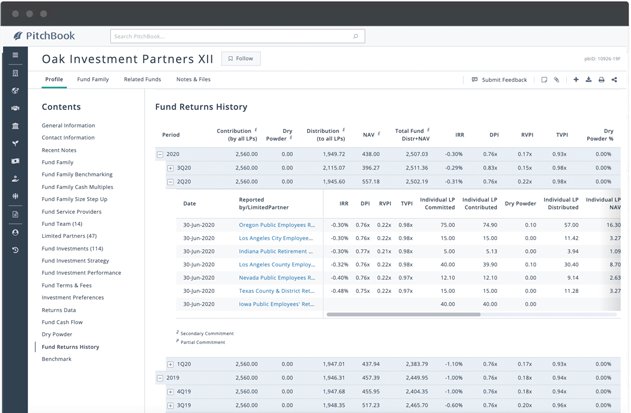

Once you’ve created your own custom benchmark, you can assess the returns data for individual funds included within it.

Dive deeper into the data to pinpoint how a fund manager is generating returns with insight on funds’ individual investments and associated liquidity events.

Comparing funds is fast and easy with unparalleled detail on benchmarked funds. Leverage PitchBook’s unrivaled data to better understand and contextualize the performance of individual funds and up to 10 funds for relative performance.

With access to six fund term and fee metrics and the ability to display a secondary index, you get another layer of transparency when evaluating fund managers and conducting market analysis.